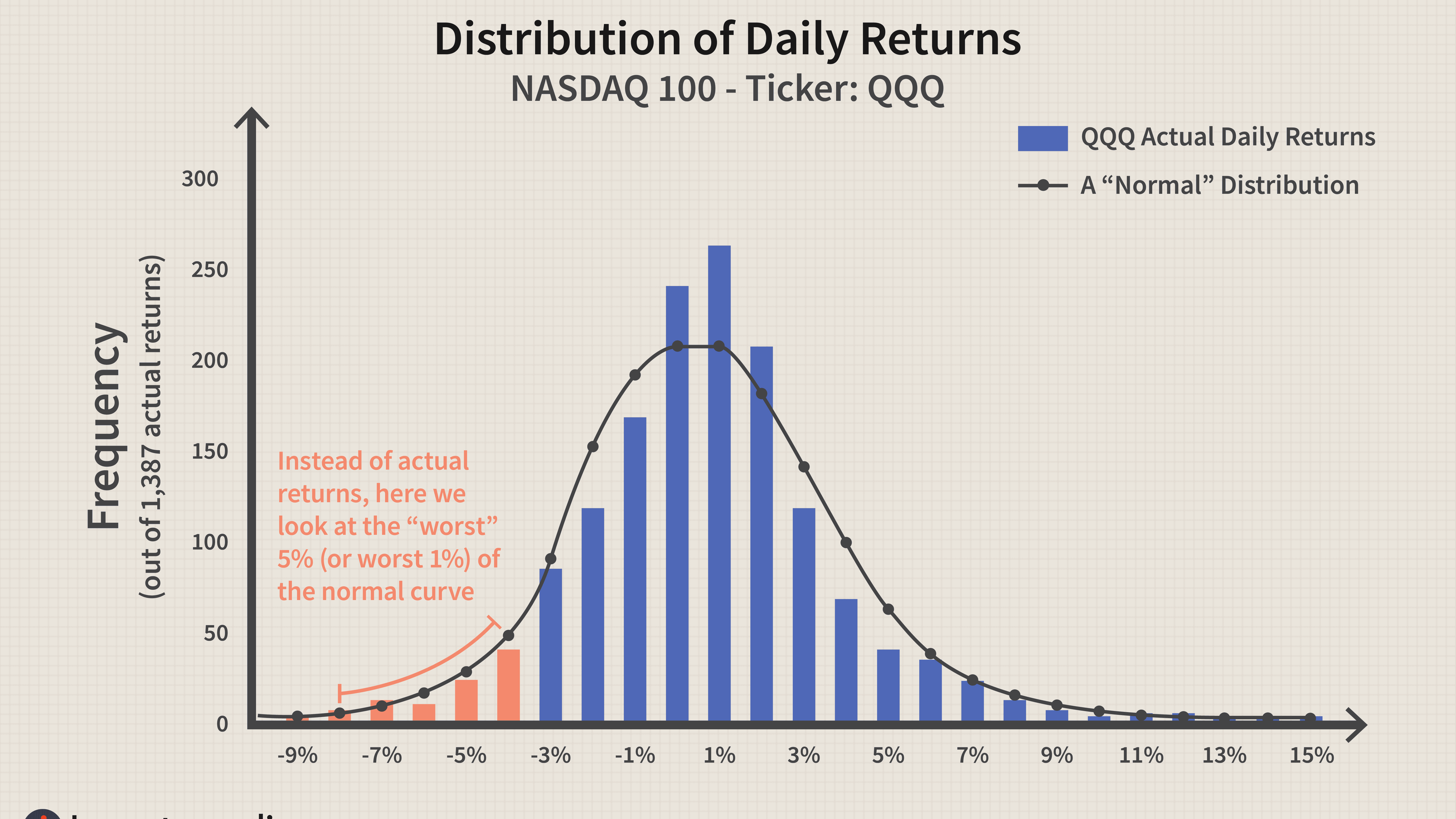

Price risk refers the risk that an asset's worth will fall in the future. This could happen in any financial instrument or commodity. Due to the multitude of market factors that could cause a specific asset's price to drop, hedge funds tend to define price risk more broadly. Hedging is vital as it can help you make a profit or fail with your investment.

Investments

When investing, price risk should be considered. The price of shares, whether they are equities, stocks, or commodities, can fluctuate over time. Investors could lose all or part their investment if the price fluctuates. Share prices can also fluctuate because of changes in the market or general trends. This is an important aspect of investing.

Commodities

There are risks associated to investing in commodity prices. One of these risks is the volatility in price movements. It may be higher that other assets. Metal prices can vary by up to 30 per cent, for example. This makes commodities' price risk more complicated than other financial assets.

Foreign exchange

A wide variety of factors are causing extreme volatility in the currency market right now. The COVID-19 pandemic, Brexit and the U.S.-China Trade War are just a few of the factors that have caused volatility in the currency market. This volatility is unusually high for developed markets, which have been relatively stable in periods of calm or tranquility.

Financial instruments

This book is designed to help students understand price risk in financial instruments. This includes options as well as futures contracts. These contracts require parties that they perform a certain action. A futures contract would require the buyer to purchase the underlying asset. A buyer can also purchase or sell securities by way of an option.

Leverage

Both individuals and businesses use leverage to make investments. It can be used to kick-start a new venture or increase shareholder wealth. You can also use it for a home purchase or college education. It's crucial to be able to use it effectively.

Hedging

This strategy can be used by businesses to hedge against price volatility. It is typically done with a range of financial instruments. This can be used in all areas of business. A manufacturing company would be able to hedge against foreign currency fluctuations if it sells its products internationally. Hedging is not free.

FAQ

What are the main styles of management?

The three major management styles are authoritarian (left-faire), participative and laissez -faire. Each style has its advantages and disadvantages. Which style do your prefer? Why?

Authoritarian - The leader sets the direction and expects everyone to comply with it. This style is best when the organization has a large and stable workforce.

Laissez-faire: The leader lets each person decide for themselves. This style is best when the organization has a small but dynamic group.

Participative – Leaders are open to suggestions and ideas from everyone. This approach works best in small organizations where everyone feels valued.

What is Six Sigma?

Six Sigma uses statistics to measure problems, find root causes, fix them, and learn from past mistakes.

First, identify the problem.

Next, data will be collected and analyzed to determine trends and patterns.

Then, corrective actions can be taken to resolve the problem.

The data are then reanalyzed to see if the problem is solved.

This continues until you solve the problem.

What is the difference in leadership and management?

Leadership is all about influencing others. Management is about controlling others.

Leaders inspire followers, while managers direct workers.

A leader motivates people and keeps them on task.

A leader develops people; a manager manages people.

Statistics

- This field is expected to grow about 7% by 2028, a bit faster than the national average for job growth. (wgu.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

External Links

How To

How do I get my Six Sigma License?

Six Sigma is an effective quality management tool that can improve processes and increase productivity. It's a system that allows companies to get consistent results from operations. The name "Sigmas" comes from the Greek words "sigmas", meaning "six". Motorola developed this process in 1986. Motorola realized that it was important to standardize manufacturing processes so they could produce products quicker and cheaper. There were many people doing the work and they had difficulty achieving consistency. To solve this problem, they decided to use statistical tools such as control charts and Pareto analysis. They would then apply these techniques to all aspects of their operation. After applying the technique, they could make improvements wherever there was potential. There are three main steps to follow when trying to get your Six Sigma certification. First, you need to determine if your qualifications are valid. You will need to complete some classes before you can start taking the tests. You can then start taking the tests once you have completed those classes. You'll want to study everything you learned during the class beforehand. Once you have completed the class, you will be ready for the test. If you pass, then you will become certified. Finally, your certifications will be added to your resume.